World Mana

Your Trust & Agent Solution

Grab The “More Privacy while doing Real Estate Deals - Entity Tool Kit” (FLASH SALE - Ending Soon)

I’m excited and want to share something amazing with a handful of savvy Real Estate investors…

But its my mission…

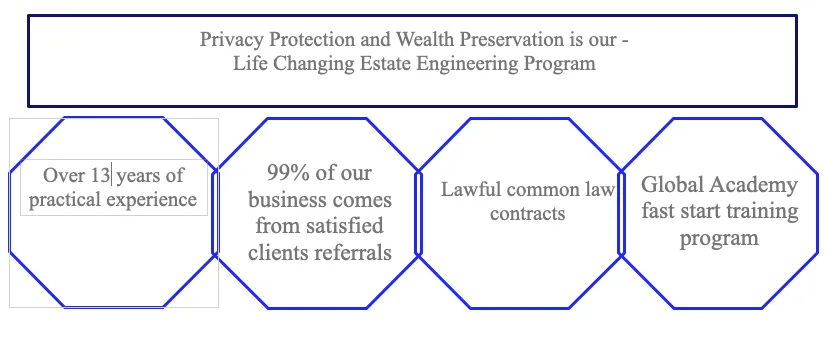

“To provide the best lawful privacy protection and wealth preservation strategies”

I’ve spent the last two years obsessively trying to figure out how to help more of my REI People with their entities….most are still using their personal names on Assignments…

…rather than seeing more people struggle with this, I have the solution, which I have actually been doing myself since 2013… see back in 2009 I spent about 7 months learning from an ex IRS Agent down in Mexico, the legal secrets to privacy and asset protection in the United States…

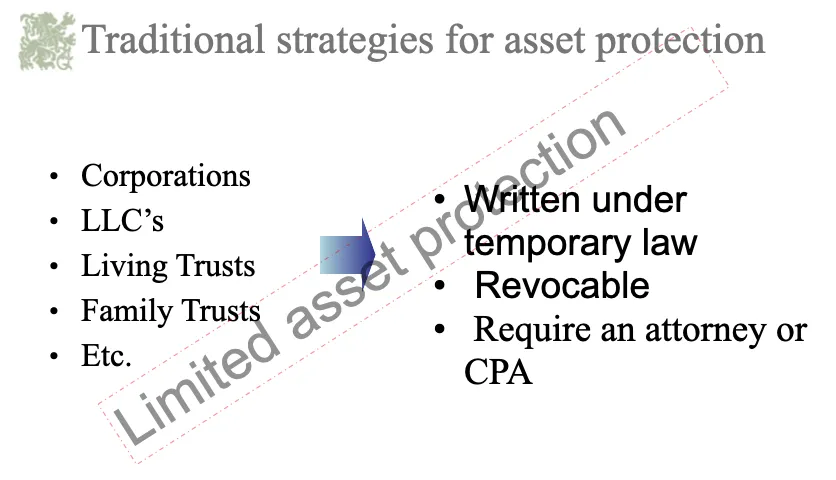

The thing is…Most Real Estate Investors just go and get a LLC in their home state and they think their good to go….

But wait… did you use your own name on the registration? Or worse yet, did you list your home address?

I’m sharing a SAVVIER way.

The secret is to use proven strategies that work… and EXISTING SOLUTIONS to turn your REI business into a legit business, that has privacy and asset protection and real tax benefits….

…then you just go out an do it. TAKE ACTION, that is.

Then the next time you do a deal and take it to Title, you know your privacy is good to go …

So here is where you come in…

Would you like to have full access to my “More Privacy WITHOUT the Expensive Lawyers Tool-Kit” also known as my “My Entity Tool Kit”

As a way of sharing the love and getting these strategies into more hands…

I am going to make sure your entities are created so you have the best structurefor long term use with capacity to grow the entity tree, as your business grows.

And instead of paying big a Big Law Firm $5,800 You could have us build it for you.

My team will build it for you for $1,700…

What does that include?

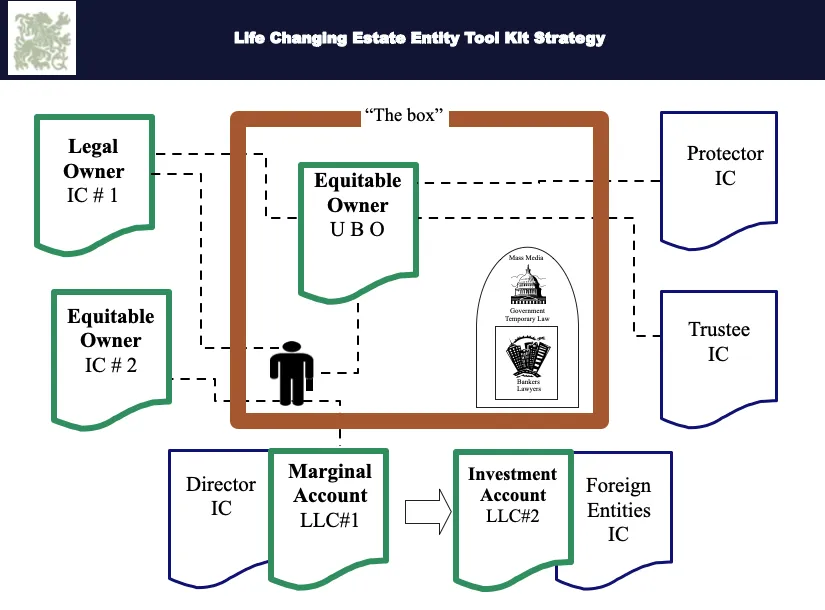

You get a whole Entity Tree designed to give you maximum Privacy and Asset Protection, with pass through tax advantages as well.

First you get two non statutory Irrevocable Trusts:

1: a holding trust company - IC#12: a pass through trust - IC#23: One Wyoming LLC to work in commerce in the Public . Additional WY LLC’s with EIN’s are $225 each. Your name is not on anything, except the private Trust docs.

BTW: This includes our Virtual Office with AI technology, if you need one. Where you can have a local number for phone calls with Website, with Agent Service and a mail address in Dallas or Miami. First year is included…each year thereafter is $350.

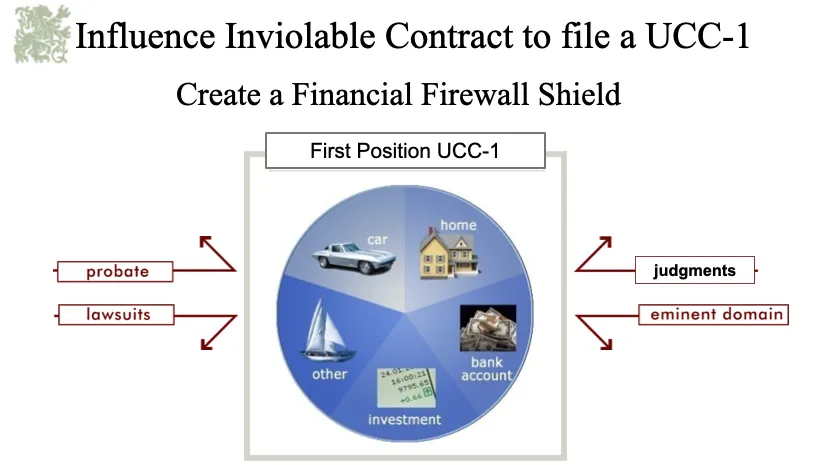

… AND you could learn how to become judgment and lawsuit proof if you use your entities correctly.

The Business Trust is for investors.

Capital Gains Short Term 23.8% Long Term either 15% or 20%Interest Income between 10% - 37% depending on your tax bracket

Dividend Income between 10% - 37% depending on your tax bracket

Rental Income between 10% - 37% depending on your tax bracket

Royalties between 10% - 35% depending on your tax bracket

The Rockefellers and US Presidents use the Business Trust...

(THIS IS UNLIKE any other entity Solution out there)

** I’ve used my Entity Tree for years now and have had many legal successes.

—> Learn More here

PLUS, you’ll also get all this too…

** Occasional Zoom Trainings with Q + A Session

You will have the ability to open up either Trust or LLC bank accounts, or both!

There’s SO MUCH MORE too, I’ve been quietly learning this stuff since 2009, so I can’t wait to share it with you.

I love hanging out and brainstorming with Investors.

I’ll put on Q & A sessions over zoom. (Dates TBD)

Here’s all you gotta do to come out and join the party.

Hit the link below

It’s only $1,700 and I fully expect you to make that back with just 1 deal.

** As a fast action bonus I’ll personally meet 1 on 1 with the first 5 people who sign up and I will do a Q + A for you.

I’m considering shutting this down or raising the price back to $5,900.

I don’t have a date on when that will happen…

But I’d hate for you to be mad at me when it does.

So here’s your chance to get it before that happens.

So don’t wait around if you’re interested.

How secure is your current Asset Protection Strategy?

Are you using your personal name on stuff?

Are you using your name (or that of your spouse) or a Corporation to title your home?

Have you titled real estate (rental property or vacation home) or other personal property such as a boat or a plane in your name (or that of your spouse) or in a LLC or similar statutory entity?

How secure is your current Asset Protection Strategy?

Do you have more than $50,000 asset equity value?

Do you have life insurance on your estate for long-term succession costs?

Are you subject to frivolous law suits?

5 things you should know for protecting

your wealth:

Do not title property in your personal name or that of your spouse.

Do not title property in a statutory created entity (LLC, Trust, Corporation, etc.).

All assets have two owners (equitable and legal).

Use constitutionally protected contracts as equitable and legal owners.

Get rid of your ego and become a center of influence.

Why should you protect your assets?

Privacy

Estate Taxes

criminal intent people

Divorce

Probate

Bankruptcy

Law Suite happy people

Tight Regulations

What are your risks?

You have a one-in-three chance of being named in a civil lawsuit this year if you own a business, do Real Estate, do marketing for deals, investments or any lifetime equity values!

Your responsibility:

Protect what you’ve worked so hard to accumulate.

World Mana Mission Statemen

“To provide the best lawful privacy protection and wealth preservation strategies”

© 2020 World Mana Trust and Agent Services